1.

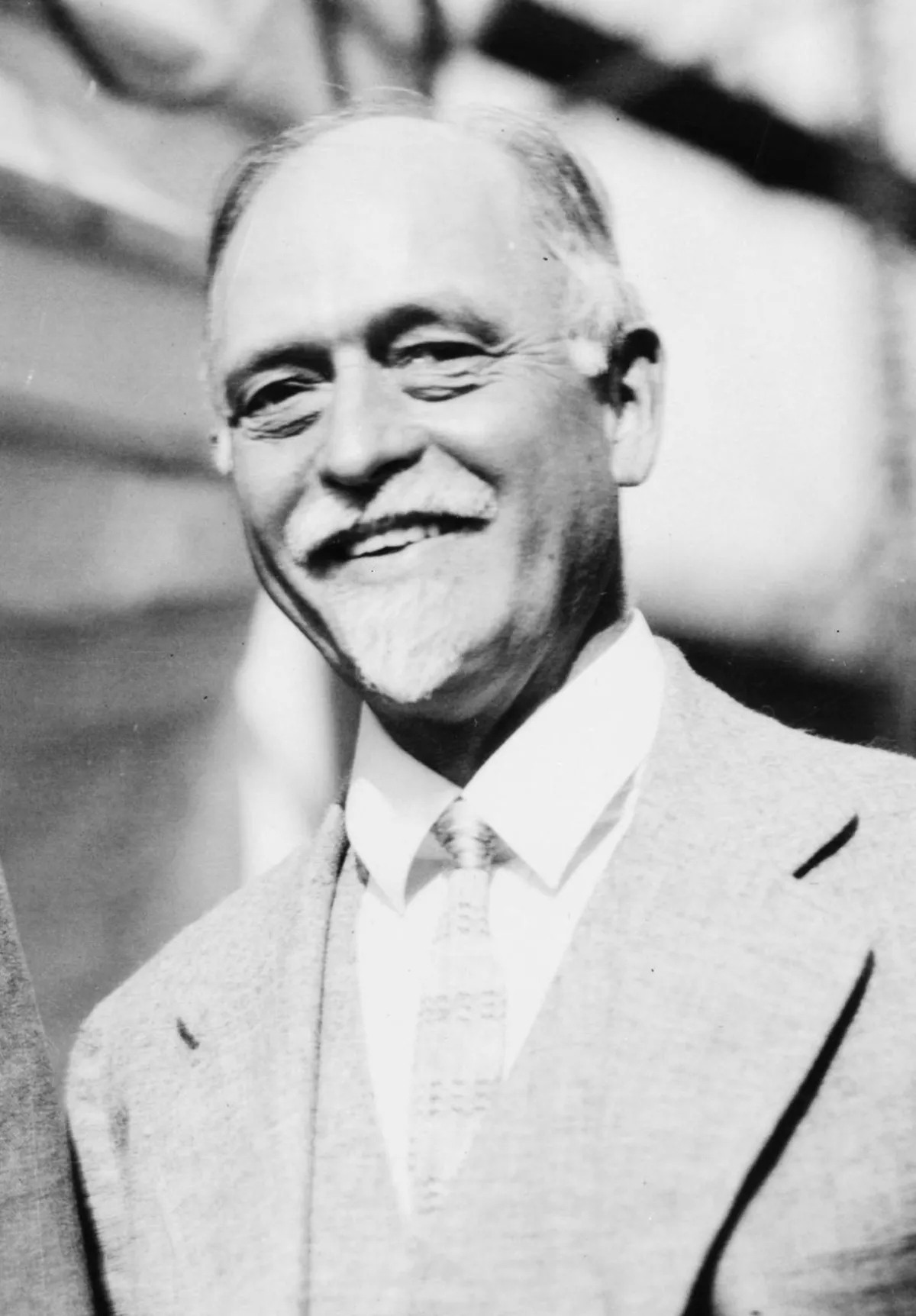

1. Irving Fisher was an American economist, statistician, inventor, eugenicist and progressive social campaigner.

1.

1. Irving Fisher was an American economist, statistician, inventor, eugenicist and progressive social campaigner.

Irving Fisher was one of the earliest American neoclassical economists, though his later work on debt deflation has been embraced by the post-Keynesian school.

Irving Fisher was a pioneer in the rigorous study of intertemporal choice in markets, which led him to develop a theory of capital and interest rates.

Irving Fisher was a pioneer of econometrics, including the development of index numbers.

Irving Fisher was perhaps the first celebrity economist, but his reputation during his lifetime was irreparably harmed by his public statement, just nine days before the Wall Street Crash of 1929, that the stock market had reached "a permanently high plateau".

Irving Fisher's reputation has since recovered in academic economics, particularly after his theoretical models were rediscovered in the late 1960s to the 1970s, a period of increasing reliance on mathematical models within the field.

Irving Fisher was one of the foremost proponents of the full-reserve banking, which he advocated as one of the authors of A Program for Monetary Reform where the general proposal is outlined.

Irving Fisher's father was a teacher and a Congregational minister, who raised his son to believe he must be a useful member of society.

Irving Fisher then supported his mother, brother, and himself, mainly by tutoring.

Irving Fisher graduated first in his class with a BA degree in 1888, having been elected as a member of the Skull and Bones society.

In 1891, Irving Fisher received the first PhD in economics granted by Yale.

Irving Fisher's thesis, published by Yale in 1892 as Mathematical Investigations in the Theory of Value and Prices, was a rigorous development of the theory of general equilibrium.

Irving Fisher based his mathematical theory on analogies with classical mechanics, providing a concordance table between mechanics and economics and visual mechanistic models of the workings of economic markets.

When he began writing the thesis, Irving Fisher had not been aware that Leon Walras and his continental European disciples had already covered similar ground.

Nonetheless, Irving Fisher's work was a very significant contribution and was immediately recognized and praised as first-rate by such European masters as Francis Edgeworth.

Irving Fisher edited the Yale Review from 1896 to 1910 and was active in many learned societies, institutes, and welfare organizations.

Irving Fisher was elected to the American Academy of Arts and Sciences in 1912.

Irving Fisher was president of the American Economic Association in 1918.

Irving Fisher was elected to the American Philosophical Society in 1927.

Irving Fisher was a prolific writer, producing journalism as well as technical books and articles, and addressing various social issues surrounding World War I, the prosperous 1920s and the depressed 1930s.

Irving Fisher made several practical inventions, the most notable of which was an "index visible filing system" which he patented in 1913 and sold to Kardex Rand in 1925.

Irving Fisher was an active social and health campaigner, as well as an advocate of vegetarianism, prohibition, and eugenics.

Irving Fisher died of inoperable colon cancer in New York City in 1947, at the age of 80.

Irving Fisher is probably best remembered today in neoclassical economics for his theory of capital, investment, and interest rates, first exposited in his The Nature of Capital and Income and elaborated on in The Rate of Interest.

Irving Fisher saw that subjective economic value is not only a function of the amount of goods and services owned or exchanged, but of the moment in time when they are purchased with money.

Irving Fisher made free use of the standard diagrams used to teach undergraduate economics but labeled the axes "consumption now" and "consumption next period".

Irving Fisher saw that his theory, via economic policy, was making an impact on society as a whole.

One of the strongest points that Irving Fisher brings out in discussing interest rates was the power of impatience.

Irving Fisher's Appreciation and Interest was an abstract analysis of the behavior of interest rates when the price level is changing.

Irving Fisher was one of the first to subject macroeconomic data, including the money stock, interest rates, and the price level, to statistical analyses and tests.

Irving Fisher espoused a more succinct explanation of the quantity theory of money, resting it almost exclusively on long run prices.

Debt-deflation is the major theory with which Irving Fisher's name is associated.

Irving Fisher was so discredited by his 1929 pronouncements and by the failure of a firm he had started that few people took notice of his "debt-deflation" analysis of the Depression.

In 1898, Irving Fisher was diagnosed with tuberculosis, the same disease that had killed his father.

Irving Fisher spent three years in sanatoria, finally making a full recovery.

Irving Fisher was one of the founders of the Life Extension Institute, under whose auspices he co-authored the bestselling book How to Live: Rules for Healthful Living Based on Modern Science, published in 1915.

Irving Fisher advocated regular exercise and the avoidance of red meat, tobacco, and alcohol.

Irving Fisher supported the legal prohibition of alcohol and wrote three booklets defending prohibition in the United States on grounds of public health and economic productivity.

Irving Fisher defended eugenics, serving in the scientific advisory board of the Eugenics Record Office and as first president of the American Eugenics Society.

When his daughter Margaret was diagnosed with schizophrenia, Irving Fisher had her treated at the New Jersey State Hospital at Trenton, whose director was the psychiatrist Henry Cotton.

At Trenton, Margaret Irving Fisher had sections of her bowel and colon removed, which eventually resulted in her death.

Irving Fisher nonetheless remained convinced of the validity of Cotton's treatment.