1.

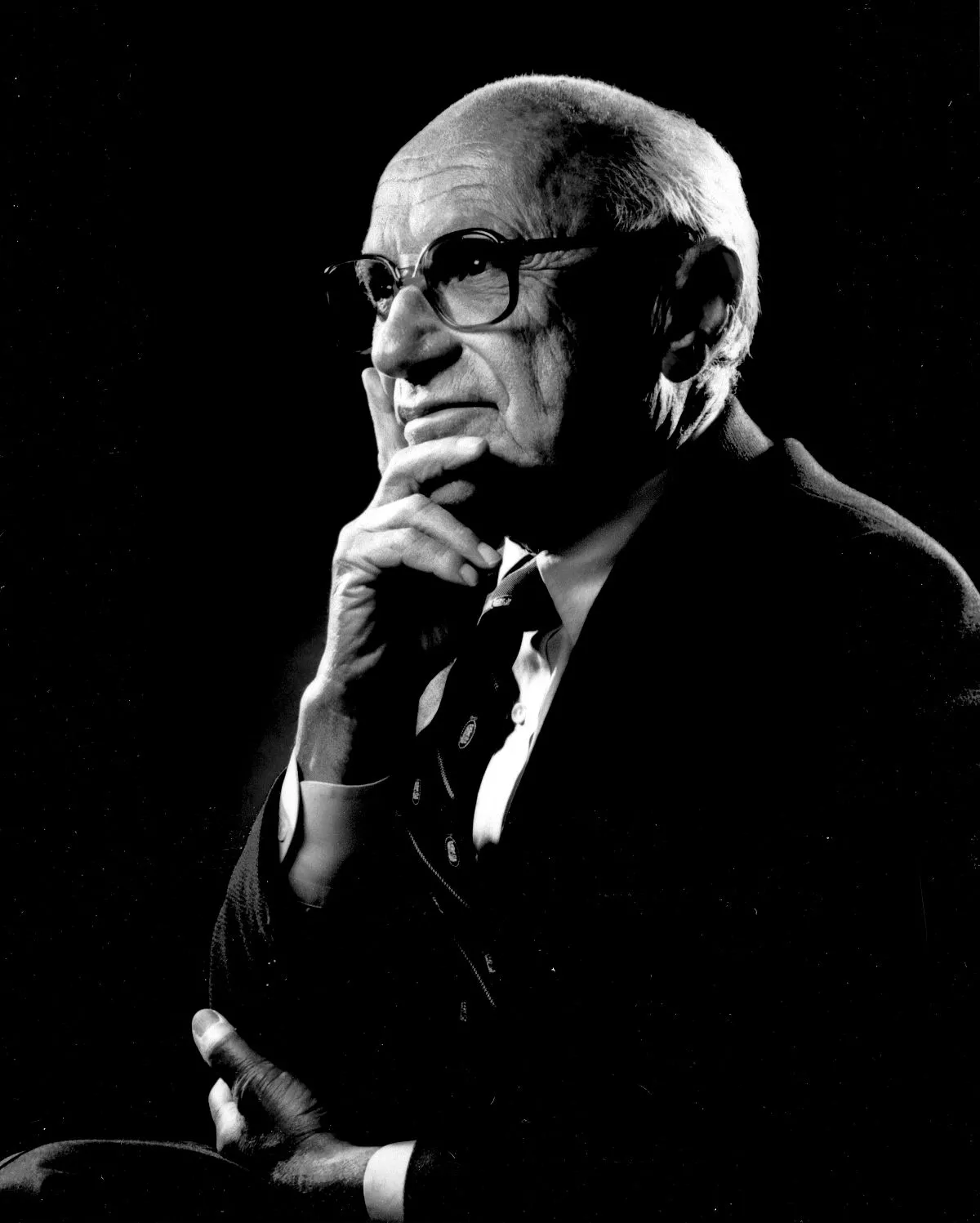

1. Milton Friedman was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and the complexity of stabilization policy.

1.

1. Milton Friedman was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and the complexity of stabilization policy.

Milton Friedman introduced a theory which would later become part of mainstream economics and he was among the first to propagate the theory of consumption smoothing.

Milton Friedman theorized that there existed a natural rate of unemployment and argued that unemployment below this rate would cause inflation to accelerate.

Milton Friedman argued that the Phillips curve was in the long run vertical at the "natural rate" and predicted what would come to be known as stagflation.

Milton Friedman promoted a macroeconomic viewpoint known as monetarism and argued that a steady, small expansion of the money supply was the preferred policy, as compared to rapid, and unexpected changes.

Milton Friedman's ideas concerning monetary policy, taxation, privatization, and deregulation influenced government policies, especially during the 1980s.

Milton Friedman's works cover a broad range of economic topics and public policy issues.

Milton Friedman was born in Brooklyn, New York City, on July 31,1912.

Milton Friedman was their fourth child and only son, as well as the youngest of the children.

Milton Friedman was the first in his family to attend a university.

Milton Friedman was awarded a competitive scholarship to Rutgers University and graduated in 1932.

Milton Friedman initially intended to become an actuary or mathematician the state of the economy, which was at this point in a depression, convinced him to become an economist.

Milton Friedman was offered two scholarships to do graduate work, one in mathematics at Brown University and the other in economics at the University of Chicago.

Milton Friedman chose the latter, earning a Master of Arts degree in 1933.

Milton Friedman was strongly influenced by Jacob Viner, Frank Knight, and Henry Simons.

Milton Friedman met his future wife, economist Rose Director, while at the University of Chicago.

Milton Friedman was influenced by two lifelong friends, Arthur Burns and Homer Johnson.

Indeed, Milton Friedman later concluded that all government intervention associated with the New Deal was "the wrong cure for the wrong disease", arguing the Federal Reserve was to blame, and that they should have expanded the money supply in reaction to what he later described in A Monetary History of the United States as "The Great Contraction".

Milton Friedman began employment with the National Bureau of Economic Research during the autumn of 1937 to assist Simon Kuznets in his work on professional income.

From 1941 to 1943 Milton Friedman worked on wartime tax policy for the federal government, as an advisor to senior officials of the United States Department of the Treasury.

Milton Friedman helped to invent the payroll withholding tax system, since the federal government needed money to fund the war.

In 1943, Friedman joined the Division of War Research at Columbia University, where he spent the rest of World War II working as a mathematical statistician, focusing on problems of weapons design, military tactics, and metallurgical experiments.

In 1945, Milton Friedman submitted Incomes from Independent Professional Practice to Columbia as his doctoral dissertation.

In 1946, Milton Friedman accepted an offer to teach economic theory at the University of Chicago.

At the time, Arthur F Burns, who was then the head of the National Bureau of Economic Research, and later chairman of the Federal Reserve, asked Friedman to rejoin the Bureau's staff.

Milton Friedman accepted the invitation, and assumed responsibility for the Bureau's inquiry into the role of money in the business cycle.

In 1951, Milton Friedman was awarded the John Bates Clark Medal, which at the time was awarded every other year to the best economist under the age of 40, by the American Economic Association.

Milton Friedman speculated he was invited to the fellowship because his views were unacceptable to both of the Cambridge factions.

Milton Friedman's research introduced the term "permanent income" to the world, which was the average of a household's expected income over several years, and he developed the permanent income hypothesis.

Milton Friedman thought income consisted of several components, namely transitory and permanent.

Milton Friedman established the formula to calculate income, with p representing the permanent component, and t representing the transitory component.

Milton Friedman's research changed how economists interpreted the consumption function, and his work pushed the idea that current income was not the only factor affecting people's adjustment household consumption expenditures.

Milton Friedman's work was later expanded on by Christopher D Carroll, especially in regards to the absence of liquidity constraints.

Milton Friedman goes through the chapters specifying an issue in each respective chapter from the role of government and money supply to social welfare programs to a special chapter on occupational licensure.

Milton Friedman concludes Capitalism and Freedom with his "classical liberal" stance that government should stay out of matters that do not need it and should only involve itself when absolutely necessary for the survival of its people and the country.

In 1977, at the age of 65, Milton Friedman retired from the University of Chicago after teaching there for 30 years.

Milton Friedman served as an unofficial adviser to Ronald Reagan during his 1980 presidential campaign, and then served on the President's Economic Policy Advisory Board for the rest of the Reagan Administration.

Ebenstein says Milton Friedman was "the 'guru' of the Reagan administration".

Milton Friedman is known now as one of the most influential economists of the 20th century.

Milton Friedman made several visits to Eastern Europe and to China, where he advised governments.

Milton Friedman was for many years a Trustee of the Philadelphia Society.

Milton Friedman had two children, David and Jan He met his wife, Rose Milton Friedman, at the University of Chicago in 1932, and wed six years later, in 1938.

Milton Friedman had an apartment in Russian Hill, San Francisco, where he lived from 1977 until his death.

Milton Friedman wrote extensively of his life and experiences, especially in 1998 in his memoirs with his wife, Rose, titled Two Lucky People.

Milton Friedman died of heart failure at the age of 94 years in San Francisco on November 16,2006.

Milton Friedman was still a working economist performing original economic research; his last column was published in The Wall Street Journal the day after his death.

Milton Friedman was best known for reviving interest in the money supply as a determinant of the nominal value of output, that is, the quantity theory of money.

Milton Friedman was the main proponent of the monetarist school of economics.

Milton Friedman maintained that there is a close and stable association between inflation and the money supply, mainly that inflation could be avoided with proper regulation of the monetary base's growth rate.

Milton Friedman famously used the analogy of "dropping money out of a helicopter", to avoid dealing with money injection mechanisms and other factors that would overcomplicate his models.

Milton Friedman's arguments were designed to counter the popular concept of cost-push inflation, that the increased general price level at the time was the result of increases in the price of oil, or increases in wages; as he wrote:.

Milton Friedman rejected the use of fiscal policy as a tool of demand management; he held the belief that the government's role in the guidance of the economy should be restricted severely.

Milton Friedman argued for the removal of government intervention in currency markets, thereby spawning an enormous literature on the subject, as well as promoting the practice of freely floating exchange rates.

Milton Friedman was known for his work on the consumption function, the permanent income hypothesis, which Milton Friedman himself referred to as his best scientific work.

Milton Friedman's argument was part of an ongoing debate among such statisticians as Jerzy Neyman, Leonard Savage, and Ronald Fisher.

Milton Friedman admitted that although privatization of national defense could reduce the overall cost, he has not yet thought of a way to make this privatization possible.

Milton Friedman's revised and updated Phillips Curve changed as a result of Robert Lucas's idea of Rational expectations, replacing the adaptive expectations Milton Friedman used.

Milton Friedman did statistical work at the Division of War Research at Columbia, where he and his colleagues came up with the technique.

Milton Friedman criticised corporate social responsibility, most famously in an op-ed in the New York Times Magazine in 1970.

Milton Friedman argued that businesses often used claims about social responsibility to increase returns and described them as "hypocritical window dressing".

Milton Friedman believed that only monopolistic corporations could routinely make altruistic expenditures on social responsibility, because in a competitive market such costs would undermine the business.

Milton Friedman was opposed to Federal Reserve policies, even during the so-called "Volcker shock" that was labeled "monetarist".

Milton Friedman believed the Federal Reserve System should ultimately be replaced with a computer program.

Milton Friedman favored a system that would automatically buy and sell securities in response to changes in the money supply.

Towards the end of his life, Milton Friedman expressed doubt about the validity of targeting the quantity of money.

Idealistically, Milton Friedman actually favored the principles of the 1930s Chicago plan, which would have ended fractional reserve banking and, thus, private money creation.

Milton Friedman was a strong advocate for floating exchange rates throughout the entire Bretton-Woods period.

Milton Friedman argued that a flexible exchange rate would make external adjustment possible and allow countries to avoid balance of payments crises.

Milton Friedman saw fixed exchange rates as an undesirable form of government intervention.

Milton Friedman did believe the introduction of a system of universal military training as a reserve in cases of war-time could be justified.

Milton Friedman still opposed its implementation in the United States, describing it as a "monstrosity".

Milton Friedman supported US involvement in the Second World War and initially supported a hard-line against Communism, but moderated over time.

However, Milton Friedman did state in a 1995 interview that he was an anti-interventionist.

Milton Friedman opposed the Gulf War and the Iraq War.

Milton Friedman was an economic advisor and speech writer in Barry Goldwater's failed presidential campaign in 1964.

Milton Friedman was an advisor to California governor Ronald Reagan and was active in Reagan's presidential campaigns.

Milton Friedman served as a member of President Reagan's Economic Policy Advisory Board starting in 1981.

Milton Friedman attended The Future of Freedom Conference, which was a meeting for libertarians, in 1990.

Dicey, Milton Friedman argued that a "free society" would constitute a desirable but unstable equilibrium, due to an asymmetry between the visible benefits and the hidden harms of government intervention; he uses tariffs as an example of a policy that brings noticeable financial benefits to a visible group, but causes worse harms to a diffuse group of workers and consumers.

Milton Friedman was supportive of the state provision of some public goods that private businesses are not considered as being able to provide.

In 1962, Milton Friedman criticized Social Security in his book Capitalism and Freedom, arguing that it had created welfare dependency.

Milton Friedman argued further that other advantages of the negative income tax were that it could fit directly into the tax system, would be less costly, and would reduce the administrative burden of implementing a social safety net.

Milton Friedman reiterated these arguments 18 years later in Free to Choose, with the additional proviso that such a reform would only be satisfactory if it replaced the current system of welfare programs rather than augment it.

Milton Friedman criticized urban renewal programs in the United States due to their racially discriminatory and economically regressive effects.

Michael Walker of the Fraser Institute and Milton Friedman hosted a series of conferences from 1986 to 1994.

Milton Friedman argued for stronger basic legal protection of economic rights and freedoms to further promote industrial-commercial growth and prosperity and buttress democracy and freedom and the rule of law generally in society.

Milton Friedman suggested medical savings accounts, repealing tax exemptions of employer-provided medical care and income-based deductibles as ways to lower health care costs in America.

Milton Friedman argued that federal involvement in health care should be restricted, with state and local governments financing health care for the poor.

Milton Friedman argued that Yellowstone National Park should be sold for private development.

Milton Friedman supported libertarian policies such as legalization of drugs and prostitution.

Milton Friedman favored immigration, saying "legal and illegal immigration has a very positive impact on the US economy".

Milton Friedman stated that immigration from Mexico had been a "good thing", in particular illegal immigration.

Milton Friedman argued that illegal immigration was a boon because they "take jobs that most residents of this country are unwilling to take, they provide employers with workers of a kind they cannot get" and they do not use welfare.

Milton Friedman famously argued that the welfare state must end before immigration, or more specifically, before open borders, because immigrants might have an incentive to come directly because of welfare payments.

Milton Friedman was against public housing as he believed it was a form of welfare.

Milton Friedman believed that one of the main arguments politicians have for public housing is that regular low-income housing was too expensive due to the imposed higher cost of a fire and police department.

Milton Friedman believed that it would only increase taxes and not benefit low-income people in the long run.

Milton Friedman was an advocate for direct cash instead of public housing believing that the people would be better off that way.

Milton Friedman argued that liberals would never agree with this idea due to them not trusting their own citizens.

Milton Friedman stated that regression has already happened with more land being left vacant due to slow construction.

Milton Friedman was against minimum wage laws; he saw them as a clear case as one can find that the precise opposite is happening when this was attempted.

Milton Friedman believed that these ideas of new minimum wage laws came from Northern factories and Unions, in an attempt to reduce competition from the South.

In 1971, Milton Friedman received the Golden Plate Award of the American Academy of Achievement.

Milton Friedman's wife Rose, sister of Aaron Director, with whom he initiated the Friedman Foundation for Educational Choice, served on the international selection committee.

Milton Friedman was awarded the Nobel Memorial Prize in Economic Sciences, the sole recipient for 1976, "for his achievements in the fields of consumption analysis, monetary history and theory and for his demonstration of the complexity of stabilization policy".

Milton Friedman spent seven days in Chile giving a series of lectures at the Pontifical Catholic University of Chile and the University of Chile.

Milton Friedman closed, stating "Such a shock program could end inflation in months".

Milton Friedman's letter suggested that cutting spending to reduce the fiscal deficit would result in less transitional unemployment than raising taxes.

Milton Friedman defended his activity in Chile on the grounds that, in his opinion, the adoption of free market policies not only improved the economic situation of Chile but contributed to the amelioration of Pinochet's rule and to the eventual transition to a democratic government during 1990.

Milton Friedman advocated for free markets which undermined "political centralization and political control".

Milton Friedman was accused of supporting the military dictatorship in Chile because of the relation of economists of the University of Chicago to Pinochet, and a seven-day trip he took to Chile during March 1975.

Milton Friedman said that he was never an advisor to Pinochet, but that a group University of Chicago students were involved in Chile's economic reforms.

Milton Friedman credited these reforms with high levels of economic growth and with the establishment of democracy that has subsequently occurred in Chile.

Milton Friedman visited Iceland during the autumn of 1984, met with important Icelanders and gave a lecture at the University of Iceland on the "tyranny of the status quo".

Milton Friedman participated in a lively television debate on August 31,1984, with socialist intellectuals, including Olafur Ragnar Grimsson, who later became President of Iceland.

Milton Friedman thought that it was fairer that only those who attended paid.

Milton Friedman strongly influenced Keith Joseph, who became Thatcher's senior advisor on economic affairs, as well as Alan Walters and Patrick Minford, two other key advisers.

Some commentators believe that Milton Friedman was not open enough, in their view, to the possibility of market inefficiencies.

Economist Noah Smith argues that while Milton Friedman made many important contributions to economic theory not all of his ideas relating to macroeconomics have entirely held up over the years and that too few people are willing to challenge them.

Milton Friedman challenged the notion that markets efficiently allocated resources and rejected Friedman's definition of liberty.

Milton Friedman has been criticized by some prominent Austrian economists, including Murray Rothbard and Walter Block.

Milton Friedman was an inveterate hater of the gold standard, denigrating its advocates as 'gold bugs'.

Milton Friedman argues that the lack of worker power caused wage suppression, increased wage inequality, and exacerbated racial disparities.