1.

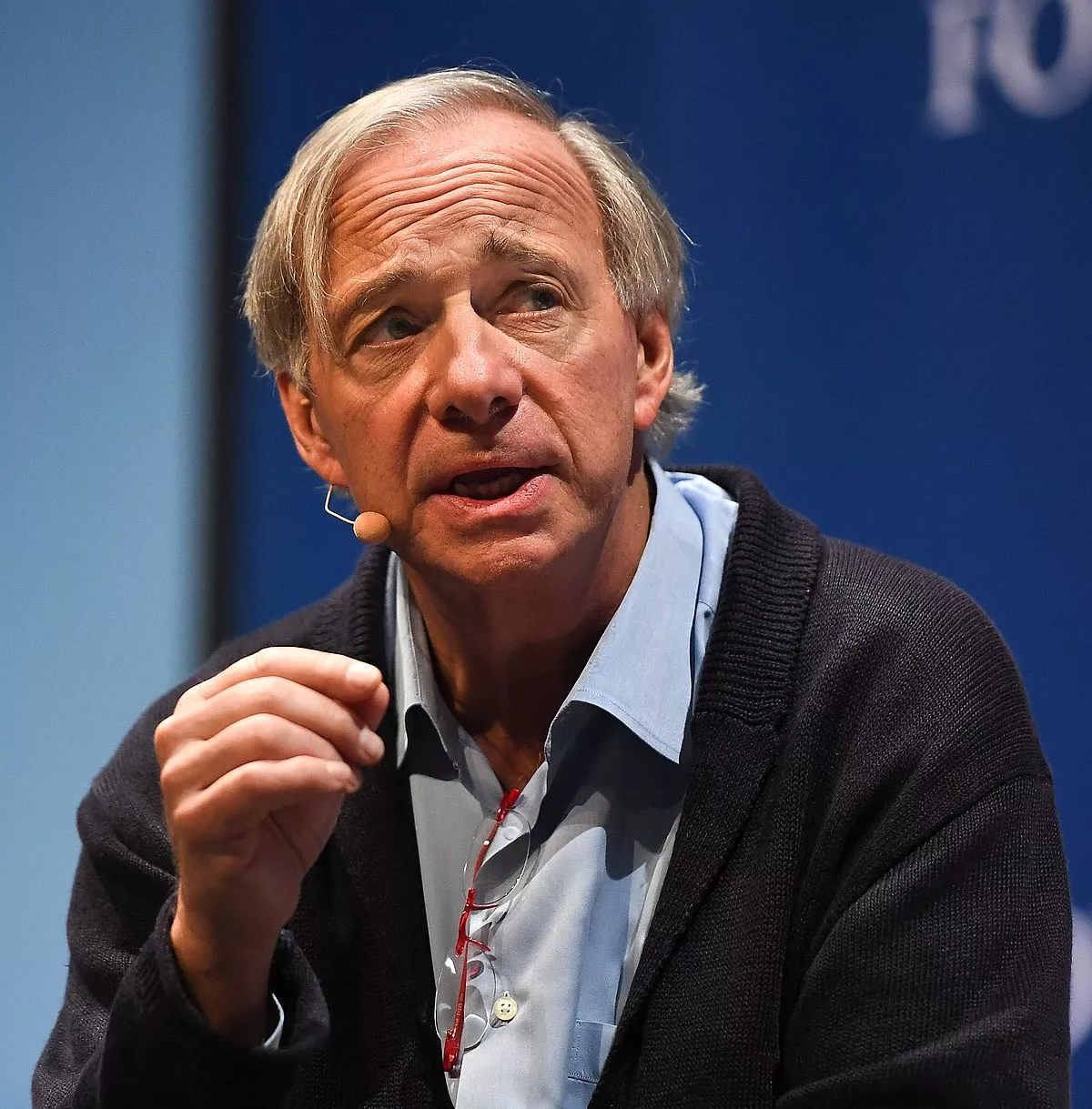

1. Raymond Thomas Dalio was born on August 8,1949 and is an American billionaire and hedge fund manager, who has been co-chief investment officer of the world's largest hedge fund, Bridgewater Associates, since 1985.

1.

1. Raymond Thomas Dalio was born on August 8,1949 and is an American billionaire and hedge fund manager, who has been co-chief investment officer of the world's largest hedge fund, Bridgewater Associates, since 1985.

Ray Dalio was born in the Jackson Heights neighborhood of New York City's Queens Borough.

Ray Dalio is the son of a jazz musician, Marino Dallolio, who "played the clarinet and saxophone at Manhattan jazz clubs such as the Copacabana," and Ann, a homemaker.

Ray Dalio caddied for many Wall Street professionals during his time there, including Wall Street veteran George Leib.

Post College, Ray Dalio worked as a clerk on the New York Stock Exchange.

Ray Dalio received an MBA from Harvard Business School in 1973.

Commodity futures had low borrowing requirements at the time, and Ray Dalio knew he could profit more handsomely than with simple stocks.

Ray Dalio later used the name Bridgewater for his hedge fund.

Ray Dalio then worked on the floor of the New York Stock Exchange and traded commodity futures.

At the firm, Ray Dalio's job was to advise cattle ranchers, grain producers, and other farmers on how to hedge risks, primarily with futures.

Ray Dalio was fired from Shearson Hayden Stone after punching his boss in the face while drunk at a New Year's Eve party in 1974.

The main areas in which Ray Dalio advised were currencies and interest rates.

Ray Dalio began publishing a paid subscription research report, Daily Observations, in which it analyzed global market trends.

Ray Dalio started to become well known outside of Wall Street after turning a profit from the 1987 stock market crash.

In 1996, Ray Dalio launched All Weather, a fund that pioneered a steady, low-risk strategy that later became known as risk parity.

In 2007, Bridgewater predicted the 2008 financial crisis, and in 2008, Ray Dalio published "How the Economic Machine Works: A Template for Understanding What is Happening Now", an essay assessing the potential of various economies by various criteria.

Ray Dalio did this by anticipating that the Federal Reserve would be forced to print a lot of money to revive the economy.

Ray Dalio went long on Treasury bonds, shorted the dollar, and bought gold and other commodities.

In 2011, Ray Dalio self-published a 123-page volume, Principles, that outlines his philosophy of investment and corporate management.

Ray Dalio has controlled Bridgewater Associates alongside co-chief investment officers Bob Prince and Greg Jensen since its inception.

Ray Dalio was co-CEO of Bridgewater for 10 months before announcing in March 2017 that he would step down as part of a company-wide shakeup by April 15.

Ray Dalio had been in a seven-year management and equity transition to find a replacement.

In reference to the personality that led him to investment success, Ray Dalio has said that he considers himself a "hyperrealist", and that he is motivated to understand the mechanisms that dictate how the world actually functions, without adding in abstract value judgments.

Ray Dalio has said he divides his holdings into two different areas: beta investments and alpha investments.

Ray Dalio's goal is to structure portfolios with uncorrelated investment returns based on risk allocations rather than asset allocations.

Ray Dalio popularized the risk parity approach, which he uses for risk management and diversification within Bridgewater Associates.

Ray Dalio employs an investment strategy that blends conventional diversification with "wagers on or against markets around the world", according to Bloomberg.

Ray Dalio's strategy uses an optimal risk target level as its basis for investing.

Ray Dalio began using the term "d-process" in February 2009 to describe the deleveraging and deflationary process of the subprime mortgage industry as distinct from a recession, and subsequently incorporated the term into his investment philosophy.

In October 2020, Ray Dalio cautioned people to not be blind to China's rise, arguing that it had continued to emerge as a global superpower.

Ray Dalio claimed that China had succeeded in "exceptional ways", including high economic performance in spite of the COVID-19 pandemic, some of the lowest COVID-19 case rates, and being the center of half of all listed initial public offerings globally.

Ray Dalio asserted that when he visited China in 1984, high-ranking officials would marvel at basic technology such as calculators, calling them "miracle devices".

Ray Dalio argued that China was now on par with the US in advanced technologies and would probably take the lead in the next five years.

Ray Dalio has downplayed and denied Chinese human rights violations, instead likening the Chinese government to a "strict parent," with such stances garnering criticism.

Ray Dalio published Principles for Navigating Big Debt Crises in 2018 and Principles for Dealing with the Changing World Order in 2021.

In 2021, Ray Dalio produced a free online personality assessment called PrinciplesYou.

Ray Dalio has suffered from Barrett's esophagus, a form of gastroesophageal reflux disease, a pre-malignant condition that if not treated properly can lead to cancer.

In February 2020, the Ray Dalio Foundation donated $10 million to support China's coronavirus recovery efforts in response to the COVID-19 pandemic.

Ray Dalio has backed the Volcker Alliance, the public policy group headed by former Federal Reserve chair Paul Volcker.

Ray Dalio is an avid outdoorsman, and has hunted cape buffalo, grouse, elk, and warthog.