1.

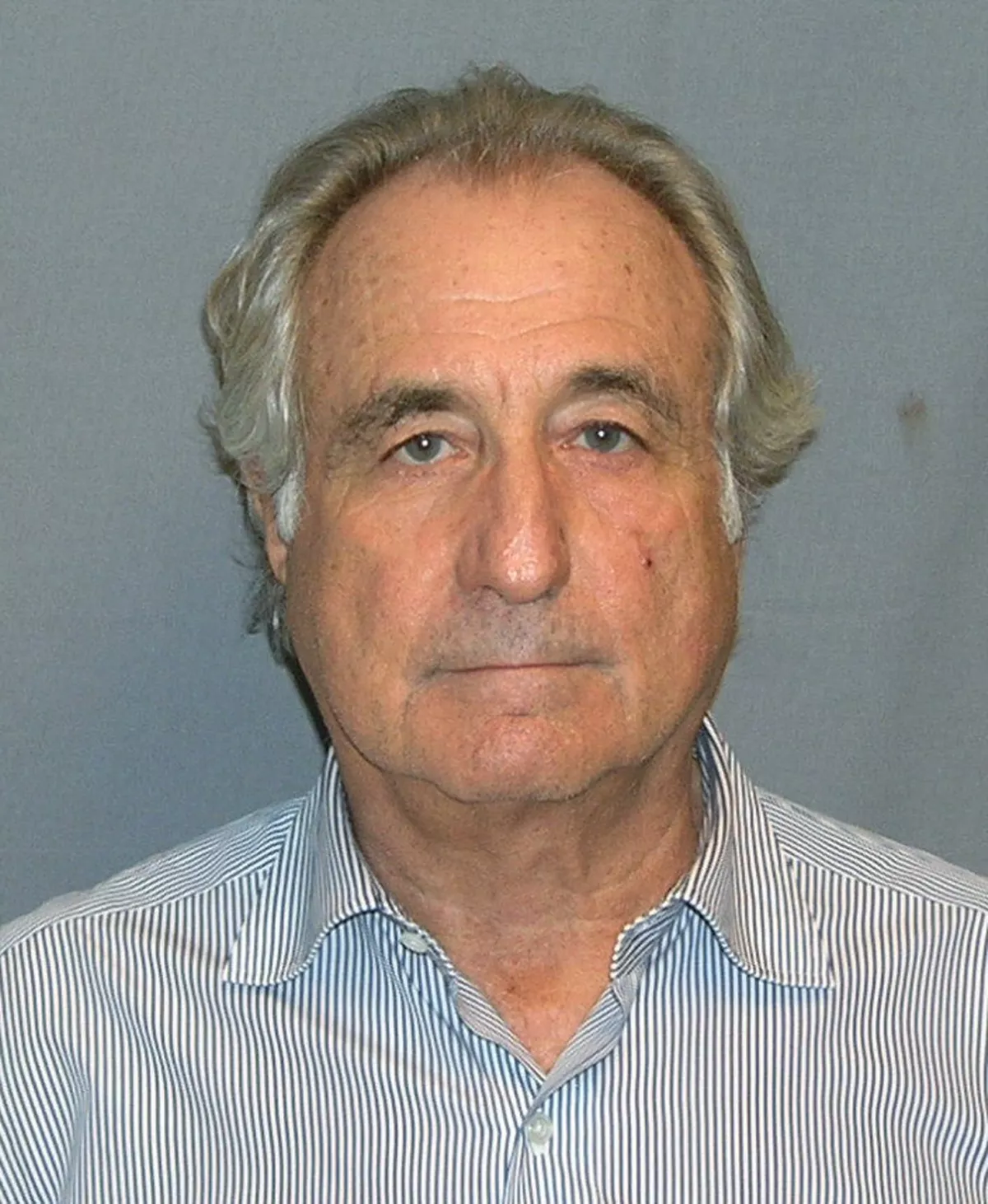

1. Bernie Madoff was at one time chairman of the Nasdaq stock exchange.

1.

1. Bernie Madoff was at one time chairman of the Nasdaq stock exchange.

Bernie Madoff's firm had two basic units: a stock brokerage and an asset management business; the Ponzi scheme was centered in the asset management business.

Bernie Madoff served as the company's chairman until his arrest on December 11,2008.

On December 10,2008, Bernie Madoff's sons Mark and Andrew told authorities that their father had confessed to them that the asset management unit of his firm was a massive Ponzi scheme, and quoted him as saying that it was "one big lie".

On March 12,2009, Bernie Madoff pleaded guilty to 11 federal felonies and admitted to turning his wealth management business into a massive Ponzi scheme.

Bernie Madoff said that he began the Ponzi scheme in the early 1990s, but an ex-trader admitted in court to faking records for Bernie Madoff since the early 1970s.

On June 29,2009, Bernie Madoff was sentenced to 150 years in prison, the maximum sentence allowed.

Bernie Madoff was born on April 29,1938, in Brooklyn, New York City, to Sylvia and Ralph Bernie Madoff, who was a plumber and stockbroker.

Bernie Madoff was the second of three children; his siblings are Sondra Weiner and Peter Madoff.

Bernie Madoff attended the University of Alabama for one year, where he became a brother of the Tau chapter of the Sigma Alpha Mu fraternity, then transferred to and graduated from Hofstra University in 1960 with a Bachelor of Arts in political science.

In 1960, Madoff founded Bernard L Madoff Investment Securities LLC as a broker-dealer for penny stock with $5,000 that he earned from working as a lifeguard and irrigation sprinkler installer, and a loan of $50,000 from his father-in-law, accountant Saul Alpern, who referred a circle of friends and their families.

Bernie Madoff was "the first prominent practitioner" of payment for order flow, in which a dealer pays a broker for the right to execute a customer's order.

Bernie Madoff argued that these payments did not alter the price that the customer received.

Bernie Madoff viewed the payments as a normal business practice:.

Bernie Madoff was active with the National Association of Securities Dealers, a self-regulatory securities-industry organization.

Bernie Madoff served as chairman of its board of directors, and was a member of its board of governors.

Bernie Madoff met Ruth Alpern while attending Far Rockaway High School and the two began dating.

Bernie Madoff was employed at the stock market in Manhattan before working in Madoff's firm, and she founded the Madoff Charitable Foundation.

Bernard and Ruth Bernie Madoff had two sons: Mark, a 1986 graduate of the University of Michigan, and Andrew, a 1988 graduate of University of Pennsylvania's Wharton Business School.

Mark Bernie Madoff owed his parents $22 million, and Andrew Bernie Madoff owed them $9.5 million.

In March 2003, Andrew Bernie Madoff was diagnosed with mantle cell lymphoma and eventually returned to work.

Bernie Madoff was named chairman of the Lymphoma Research Foundation in January 2008, but resigned shortly after his father's arrest.

Peter Bernie Madoff remained the targets of a tax fraud investigation by federal prosecutors, according to The Wall Street Journal.

Bernie Madoff owned a home in France and an 8,700-square-foot house in Palm Beach, Florida, where he was a member of the Palm Beach Country Club, where he searched for targets of his fraud.

Sheryl Weinstein, former chief financial officer of Hadassah, disclosed in a memoir that she and Bernie Madoff had had an affair more than 20 years earlier.

Bernie Madoff admitted having helped Madoff create a phony paper trail, the false account statements that were supplied to clients.

Bernie Madoff had a heart attack in December 2013, and reportedly had end-stage renal disease.

Bernard Bernie Madoff served on the board of directors of the Securities Industry Association, a precursor of SIFMA, and was chairman of its trading committee.

Bernie Madoff resigned from the board of directors of SIFMA in December 2008, as news of the Ponzi scheme broke.

From 2000 to 2008, the Bernie Madoff brothers donated $56,000 directly to SIFMA, and paid additional money as sponsors of industry meetings.

In 2004, Genevievette Walker-Lightfoot, a lawyer in the SEC's Office of Compliance Inspections and Examinations, informed her supervisor branch chief Mark Donohue that her review of Bernie Madoff found numerous inconsistencies, and recommended further questioning.

However, she was told by Donohue and his boss Eric Swanson to stop work on the Bernie Madoff investigation, send them her work results, and instead investigate the mutual fund industry.

At least some of the SEC investigators doubted whether Bernie Madoff was even trading.

The Williams Report questioned Kotz's work on the Bernie Madoff investigation, because Kotz was a "very good friend" of Markopolos.

In 1999, financial analyst Harry Markopolos had informed the SEC that he believed it was legally and mathematically impossible to achieve the gains Bernie Madoff claimed to deliver.

Bernie Madoff was ignored by the SEC's Boston office in 2000 and 2001, as well as by Meaghan Cheung at the SEC's New York office in 2005 and 2007 when he presented further evidence.

Bernie Madoff has since co-authored a book with Gaytri D Kachroo, the leader of his legal team, titled No One Would Listen.

The Federal Bureau of Investigation report and federal prosecutors' complaint says that during the first week of December 2008, Bernie Madoff confided to a senior employee, identified by Bloomberg News as one of his sons, that he said he was struggling to meet $7 billion in redemptions.

For years, Bernie Madoff had simply deposited investors' money in his business account at JPMorgan Chase and withdrew money from that account when they requested redemptions.

Bernie Madoff had intended to wind up his operations over the remainder of the week before having his sons turn him in; he directed DiPascali to use the remaining money in his business account to cash out the accounts of several family members and favored friends.

On December 11,2008, Bernie Madoff was arrested and charged with securities fraud.

Bernie Madoff posted $10 million bail in December 2008 and remained under 24-hour monitoring and house arrest in his Upper East Side penthouse apartment until his guilty plea on March 12,2009.

Chin ruled that Bernie Madoff was a flight risk because of his age, his wealth, and the prospect of spending the rest of his life in prison.

In February 2009, Bernie Madoff reached an agreement with the SEC.

For example, when Bernie Madoff determined a customer's return, one of the back office workers would enter a false trade report with a previous date and then enter a false closing trade in the amount required to produce the required profit, according to the indictment.

Bernie Madoff knew that if the amount he "managed" became known, investors would question whether he could trade on the scale he claimed without the market reacting to his activity, or whether there were enough options to hedge his stock purchases.

Bernie Madoff admitted during his March 2009 guilty plea that the essence of his scheme was to deposit client money into a bank account, rather than invest it and generate steady returns as clients had believed.

Bernie Madoff maintained that he began his fraud in the early 1990s, though prosecutors believed it was underway as early as the 1980s.

An investigator charged with reconstructing Bernie Madoff's scheme believes that the fraud was well under way as early as 1964.

Reportedly, Bernie Madoff told an acquaintance soon after his arrest that the fraud began "almost immediately" after his firm opened its doors.

Bernie Madoff targeted wealthy American Jewish communities, using his in-group status to obtain investments from Jewish individuals and institutions.

About half of Bernie Madoff's investors were "net winners", earning more than their investment.

Erin Arvedlund, who publicly questioned Bernie Madoff's reported investment performance in 2001, stated that the actual amount of the fraud might never be known, but was likely between $12 and $20 billion.

Jeffry Picower, rather than Bernie Madoff, appears to have been the largest beneficiary of Bernie Madoff's Ponzi scheme, and his estate settled the claims against it for $7.2 billion.

On March 12,2009, Bernie Madoff pleaded guilty to 11 federal felonies, including securities fraud, wire fraud, mail fraud, money laundering, making false statements, perjury, theft from an employee benefit plan, and making false filings with the SEC.

The plea was the response to a criminal complaint filed two days earlier, which stated that over the past 20 years, Bernie Madoff had defrauded his clients of almost $65 billion in the largest Ponzi scheme in history.

Bernie Madoff pleaded guilty to all charges without a plea bargain; it has been speculated that he did this instead of cooperating with the authorities in order to avoid naming any associates and co-conspirators in the scheme.

Bernie Madoff admitted to merely rubber-stamping Madoff's filings rather than auditing them.

Bernie Madoff's involvement made the Madoff scheme by far the largest accounting fraud in history, dwarfing the $11 billion accounting fraud masterminded by Bernard Ebbers in the WorldCom scandal.

Bernie Madoff admitted he had never made any legitimate investments with his clients' money during this time.

Bernie Madoff was committed to satisfying his clients' expectations of high returns, despite an economic recession.

Bernie Madoff admitted to false trading activities masked by foreign transfers and false SEC filings.

Bernie Madoff stated that he always intended to resume legitimate trading activity, but it proved "difficult, and ultimately impossible" to reconcile his client accounts.

Judge Chin said that Bernie Madoff had not been forthcoming about his crimes.

Bernie Madoff noted that Madoff's crimes were "off the charts", since federal sentencing guidelines for fraud only go up to $400 million in losses.

Bernie Madoff's attorney asked the judge to recommend that the Federal Bureau of Prisons place Bernie Madoff in the Federal Correctional Institution, Otisville, which was located 70 miles from Manhattan.

The judge only recommended that Bernie Madoff be sent to a facility in the Northeast United States.

On October 13,2009, it was reported that Bernie Madoff experienced his first prison yard fight with another inmate, a senior citizen.

On December 18,2009, Bernie Madoff was moved to Duke University Medical Center in Durham, North Carolina, and was treated for several facial injuries.

The Federal Bureau of Prisons said Bernie Madoff signed an affidavit on December 24,2009, which indicated that he had not been assaulted and that he had been admitted to the hospital for hypertension.

On July 29,2019, Bernie Madoff asked Donald Trump for a reduced sentence or pardon, to which the White House and Donald Trump made no comment.

Bernie Madoff was hospitalized for this condition in December 2019.

Bernie Madoff died of hypertension, atherosclerotic cardiovascular disease, and chronic kidney disease at the age of 82 in Federal Medical Center, Butner, a federal prison for inmates with special health needs near Butner, North Carolina, on April 14,2021.

Bernie Madoff was a prominent philanthropist, who served on boards of nonprofit institutions, many of which entrusted his firm with their endowments.

Bernie Madoff donated approximately $6 million to lymphoma research after his son Andrew was diagnosed with the disease.

Bernie Madoff served as the chairman of the board of directors of the Sy Syms School of Business at Yeshiva University, and as treasurer of its board of trustees.

Bernie Madoff resigned his position at Yeshiva University after his arrest.

Bernie Madoff served on the board of New York City Center, a member of New York City's Cultural Institutions Group.

Bernie Madoff served on the executive council of the Wall Street division of the UJA Foundation of New York which declined to invest funds with him because of the conflict of interest.

Bernie Madoff undertook charity work for the Gift of Life Bone Marrow Foundation and made philanthropic gifts through the Bernie Madoff Family Foundation, a $19 million private foundation, which he managed along with his wife.